Spotlight on… illegal workers aims to increase understanding of the risk posed by illegal construction workers, and identify what can be done to tackle the problem...

Examples of best practice

The Scheme aims to improve the image of construction through sharing best practice with the industry. Below are a number of examples that have been provided by contractors registered with the Scheme.

Modern Slavery Training Initiative

Unseen is a UK charity that provide safehouses and support in the community for survivors of trafficking and modern slavery. They also run the UK Modern Slavery and Exploitation Helpline and work with individuals, communities, business, governments, other charities and statutory agencies to stamp out slavery. Unseen empowers individuals and organisations to combat exploitation with expert training and creative awareness-raising…

Modern Day Slavery Graphics

As part of their site set up, this contractor has used a whole wall to create a large, visible iconographic around modern day slavery and statistics related to it along with a contact number for the modern slavery helpline – a free, confidential, 24/7 with over 200 languages. The graphic is positioned outside of a high flow area near the…

Supply Chain Modern Day Slavery Audits

As part of their commitment to removing any forms of modern day slavery from the supply chain, this contractor has set up face to face modern day slavery audits for all of their supply chain. Any supplier providing labour is audited on an annual basis, this includes a face-to-face audit at the supplier’s main office and follows a standardised set…

Closed Hand Signal Modern Slavery Awareness

This contractor has trained their site workforce and the supply chain to recognise and understand what to do in the event of someone showing them the closed hand signal, which identifies someone as being a victim of trafficking. They did this through encouraging the workforce to carry out Stronger Together’s e-learning courses and placing posters around the project on the…

Spotlight on… posters

Spotlight on… posters have been designed for general display in and around site welfare facilities. The Scheme has developed a collection of A3 posters from the series of ‘Spotlight on…’ learning toolkits. This resource has proven valuable for display on site and raising awareness amongst the workforce and visitors. To purchase these products, click here. To download a free electronic…

Digitising Right to Work Checks

All employers in the UK have a responsibility to prevent illegal working. You do this by conducting simple right to work checks before you employ someone, to make sure the individual is not disqualified from carrying out the work in question by reason of their immigration status. On 27 December 2021, the government announced its intention to enable employers and landlords…

English Lessons and Other Qualifications for Speakers of Other Languages

This contractor have been working collaboratively with Lambeth College and London South Bank University (LSBU), to pilot a programme which aims to upskill diverse members of their workforce who are foreign and often struggle with the English language, providing them with the opportunity to learn and feel more comfortable engaging with other people on site. This voluntary course will also…

Hope for Justice Site Membership

On this project they have undergone four online sessions with external organisation Hope for Justice speaking to their team and contractor supervisors about raising awareness of Modern Slavery with specific reference to the construction industry. They had attendance of around 80 people from site, and was followed up by multi-lingual posters and hand outs to share across site. Since these…

Scotland Against Modern Slavery

The construction industry is particularly at risk of modern slavery and unethical labour practices. To help combat this, the contractor have become Corporate Partners of Scotland Against Modern Slavery, a forum including the Scottish Government, public organisations and businesses. Scotland Against Modern Slavery exists to help eradicate the atrocity of human trafficking and raise awareness across the Scottish business community…

Ethical Labour Practices and Human Rights Webinar

The project Team marked International Human Rights Day by hosting a live webinar with guest speaker Annabel Short, Senior Advisor of the Built Environment for the Institute for Human Rights and Business (IHRB). The webinar was open to all staff as well as clients, consultants and supply chain partners. The discussion covered what human rights mean in practice in the…

Working Conditions Survey as Part of a Modern Slavery Strategy

As part of the contractors strategy to help eradicate modern slavery, one of the projects conducted a working conditions survey among the site operatives in partnership with a survey provider. Each worker was invited to participate in this anonymous survey, to answer comprehensive questions about their working conditions, safety, and wellbeing. The survey process measured working conditions and helped to…

Stronger Together Training

The issue of modern slavery is an enduring challenge faced by the construction industry. With often complex and evolving supply chains, construction can be seen as an easy target for those wishing to take advantage of individuals who find themselves in a situation that makes them vulnerable to illegal practices. Multiplex recognises the importance of the industry coming together in…

Right to Work Checks Simplified

The Home Office has taken a step forward in streamlining right to work checks. Previously, employers have needed to request paper documents alongside completing an online questionnaire to show that they have completed the necessary checks on their employees and prospective employees. However, the paper documents are no longer needed and the whole process can be done completely online. By using…

Gangmasters and Labour Abuse Authority (GLAA) Construction Protocol

The Gangmasters and Labour Abuse Authority (GLAA) has recently released to some support tools to complement their Construction Protocol, an initiative supported by some of the leading names in the building industry, which aims to eradicate modern slavery and labour exploitation on building sites. Construction Protocol was initially launched in October 2017, and the new support resources include a presentation…

Right to Work in the UK: Spot Checks

It is important to GRAHAM to ensure that illegal working and modern slavery issues are addressed in more than just contractual terms. Sub-contractors are contractually required to perform all checks to ensure that they are complying with the law and with GRAHAM policies and contracts but it is also good practice to reinforce the messages at project level. At the…

Raising Awareness of Illegal Working

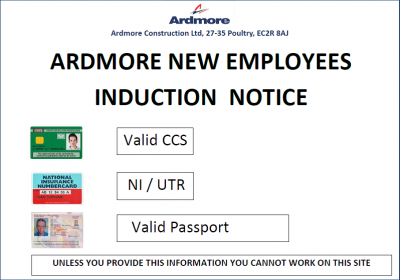

The Considerate Constructors Scheme ‘Spotlight on… illegal workers’ follow up article, coincides well with some work we have been doing at Ardmore to raise awareness of these issues. We have carried out training for all those who are responsible for checking Right to Work with a company called Safe, part of the NHS; This training specifically provided very useful guidance…

Illegal Workers and Modern Slavery

Heron Bros recognised the need to highlight the challenges the construction industry faces in relation to Illegal Workers and Human Trafficking. Heron Bros Modern Slavery Policy defines the processes in place to ensure their supply chain are conducting right to work checks and can also carry out similar spot checks. The construction company went one step further by implementing a…

Illegal Worker Checks

Illegal working is one of the biggest challenges facing the construction industry. There is a great deal of confusion surrounding the process of checking a prospective employee’s right to work, but it is essential that sites are aware that the correct processes are in place. Even if the main contractor is not legally responsible for ensuring right to work, as…

UK Modern Slavery Act e-learning

The UK’s Modern Slavery Act requires companies to demonstrate the actions being taken to ensure that modern slavery is not occurring within the supply chain. Every year they must produce a statement that quantifies the activities we have undertaken to help meet this objective. At Mace we have developed our policies in response to this legislation and begun taking positive…

Right to Work Checks on Site

It is crucial that each and every site ensures their workforce is legitimate, as illegal workers pose a grave risk to the construction industry as a whole. Not only can the presence of illegal workers pose a health and safety risk on site, but employing workers who are not eligible to work in the UK carries hefty penalties. The example…

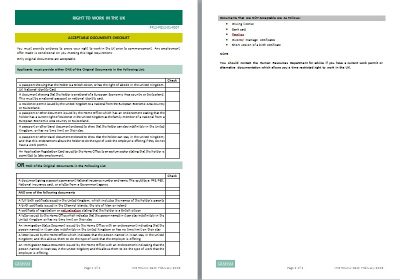

Employer’s Guide to Right to Work Checks

Illegal working often results in abusive and exploitative behaviour, the mistreatment of illegal migrant workers, tax evasion and poor housing conditions. It can also undercut legitimate businesses and have an adverse impact on the employment of people who are lawfully in the UK. Under section 15 of the Immigration, Asylum and Nationality Act 2006 (the 2006 Act), an employer may…

Modern Slavery and Ethical Sourcing

Ethical sourcing is a term that is becoming more and more prominent as governments and organisations strive to create a more global, equal and fair working environment. The focus is to ensure products are being sourced from environments where workers are treated well, paid well and working in respectable conditions. In the construction industry, we must be aware of any…

Monitoring the Legitimacy of the Workforce

In order to maintain high levels of safety and legal regulation, the industry must monitor the legitimacy of its workforce. The following procedures and checks should be in place to monitor the workforce: There should be a process in place to check the legitimacy of the workforce either before arrival on site or upon arrival, with spot checks as necessary,…

Spotting the Warning Signs of Modern Slavery

Modern slavery encompasses slavery, human trafficking, forced or compulsory labour and domestic servitude. In March 2015, the Modern Slavery Act was introduced by the UK government to give protection to victims and hand-down harsh penalties to offenders, who now face up to life imprisonment if they are convicted of modern slavery offences. Individuals working in the country illegally due to…

Using Spot Checks to Prevent Illegal Working

Individuals working in the country illegally due to their immigration status will often be victims of abuse and exploitations or caught in a situation now defined as modern slavery. Spot checks can be made to make sure as far as possible that everyone working on your site is doing so legally. The Home Office’s recommended Right to Work checks, is…

Modern Slavery in Construction

Modern slavery encompasses slavery, human trafficking, forced or compulsory labour and domestic servitude. In March 2015, the Modern Slavery Act was introduced by the UK government to give protection to victims and hand down harsh penalties to offenders, who now face up to life imprisonment if they are convicted of modern slavery offences. The National Crime Agency’s latest strategic assessment listed…

Workers Legally Allowed to Work in UK

Employers are expected to carry out checks to ensure that people on their sites are legally able to work in the UK. Employers should be implementing the following process: Obtain original versions of the various documents allowed/ required, which would often include a passport; Check all of the documents validity in front of the person concerned; Make and retain copies of the…